China's lending debacle: Development loans hit 13-year low

ANI

25 Jan 2023, 22:07 GMT+10

Beijing [China], January 25 (ANI): China is the world's largest bilateral lender, however, the loans committed by them to 100 developing nations fell to a 13-year low of USD 3.7 billion in 2021 due to Beijing curtailing funding for large-scale oil projects, a study from Boston University Global Development Policy Center showed.

Commitments made to 100 developing nations by the Export-Import Bank of China (China Exim Bank) and the China Development Bank (CDB) have fallen every year since hitting a record in 2016 as the lenders scaled back financing even before the COVID-19 pandemic struck in 2020.

"We expect an overall shift toward lower volume, higher quality investment from China," Kevin Gallagher, director of the university's Global Development Policy Center, told Reuters.

"China's domestic priorities beyond COVID-19 are still significant, given the large amounts of debt and the swings in renminbi that may necessitate the need to be conservative with dollar holdings so they can serve as insurance on the home front."China Exim Bank and CBD made USD 498 billion in loan commitments globally between 2008 and 2021 as part of Beijing's "Belt and Road" infrastructure initiative, reported The Star.

General purpose lending to state-owned oil companies, for example in Angola, Brazil, Ecuador, Russia and Venezuela reached USD 60 billion between 2009 and 2017.

Since then, lending has been less focused on petroleum producers, with Bangladesh and Sri Lanka among the top recipients, reported The Star.

Russia was the top recipient with USD 58 billion in loans in the 2008 to 2021 period, followed by Venezuela with USD 55 billion.

Lending to the South American oil giant, mostly for extraction and pipeline projects, was halted in 2015, two years before it defaulted on its overseas debt, reported The Star.

Angola was the third largest recipient, with USD 33 billion for projects in transport, agriculture, water and oil, with Kenya, Ethiopia and Egypt also among the top African borrowers.

However, while Chinese lending has been waning, World Bank lending has ramped up, the study found.

The Washington-based lender financed projects in developing countries worth an average of USD 40 billion annually between 2016-2019, before scaling up its response to the pandemic in 2020 when it stepped in with USD 67 billion, its largest annual commitment since 2008.

The following year, commitments were almost USD 62 billion - 17 times more than Chinese financing, reported The Star.

"The World Bank had a fixed amount of lending capacity, but this was accelerated as part of the COVID-19 response," Gallagher said, adding this might return to trend post-pandemic.

Also, the World Bank was seeking to vastly expand its lending capacity to address climate change and other global crises and would negotiate with shareholders ahead of April meetings on proposals including a capital increase and new lending tools.

Meanwhile, Western countries such as the United States and multilateral lenders are pressing Beijing to offer debt relief to emerging economies in distress, such as Zambia and Sri Lanka. China tends to disclose little on lending conditions and how it renegotiates with borrowers.

China's Belt and Road Initiative (BRI) has left scores of Lower and Middle-Income Countries (LMIC) saddled with "hidden debts." China is using debt rather than aid to establish a dominant position in the international development finance market.

China's Belt and Road Initiative (BRI) is plunging nations into massive debt. It involves one creditor country intentionally extending excessive credit to another debtor country with the alleged intention of extracting economic or political concessions from the debtor country when it becomes unable to honour its debt obligations.

For example, China took Sri Lanka's Hambantota port on a 99-year lease because of Sri Lanka's failure to pay Chinese debt. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Middle East Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Middle East Star.

More InformationInternational Business

SectionUS, Canadian farmers face rising fertilizer costs amid trade tensions

WINNIPEG, Manitoba: Farmers in the U.S. and Canada are bracing for soaring fertilizer prices as trade tensions escalate between the...

UFC-WWE parent TKO Group enters boxing with Saudi partnership

NEW YORK CITY, New York: TKO Group, the parent company of UFC and WWE, is launching a new boxing promotion in partnership with Saudi...

Andhra partners with Microsoft to equip 2 lakh youth with AI skills

Amaravati (Andhra Pradesh) [India], March 13 (ANI): The Andhra Pradesh government on Thursday signed a crucial Memorandum of Understanding...

The debt noose: Why does Africa remain trapped

The continent must unite to shape its economic future and to end its dependence on Western financial institutions In late February...

World Insights: U.S. tariffs ignite criticism at home and abroad

A Shop Canadian sign is seen at a supermarket in Vancouver, British Columbia, Canada, March 4, 2025. (Photo by Liang Sen/Xinhua) Besides...

Tata Motors, DIMO launch all-new passenger vehicle portfolio in Sri Lanka

Colombo [Sri Lanka], March 13 (ANI): Tata Motors in collaboration with its long-standing partner DIMO, has officially launched its...

International

SectionUS farmers face bankruptcy, economic uncertainty due to USDA freeze

CHICAGO/WASHINGTON, D.C.: Farmers and food groups across the U.S. are laying off workers, stopping investments, and struggling to get...

South Dakota law blocks eminent domain for carbon pipelines

SIOUX FALLS, South Dakota: A new South Dakota law banning the use of eminent domain for carbon capture pipelines has cast doubt on...

US intelligence agency orders DEIA officials to resign or face firing

WASHINGTON, D.C.: Officials working on diversity and inclusion programs at the U.S. Office of the Director of National Intelligence...

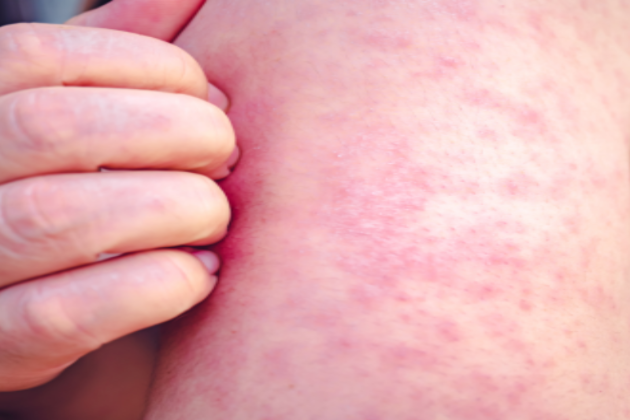

CDC study follows measles outbreak amid declining vaccination rates

WASHINGTON, D.C.: The U.S. Centers for Disease Control and Prevention (CDC) is planning an extensive study on possible links between...

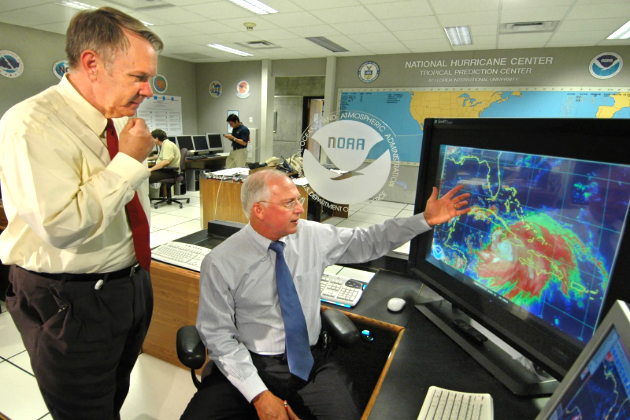

US weather agency faces big layoffs under Trump’s civil service cuts

WASHINGTON, D.C.: The U.S. weather agency, NOAA, plans to lay off 1,029 workers following 1,300 job cuts earlier this year. This...

New Mexico reports first measles-related death in over 40 years

SANTA FE: New Mexico: A New Mexico resident who died recently tested positive for measles, marking the state's first measles-related...