RBI may have to infuse Rs 1 Lakh crore by March to maintain liquidity: SBI Report

ANI

04 Mar 2025, 09:37 GMT+10

New Delhi [India], March 4 (ANI): The Reserve Bank of India (RBI) may have to inject additional Rs 1 lakh crore into the banking system by March to maintain liquidity at an equilibrium level, according to a report by the State Bank of India (SBI) research.

The report highlighted that systemic liquidity remains tight, with a deficit of approximately Rs 1.6 lakh crore as of the end of February. The average liquidity deficit is higher, at around Rs 1.95 lakh crore.

The banking system has been facing a severe liquidity crunch in recent months, making it one of the worst liquidity shortages in over a decade.

It said 'We believe around Rs 1 trillion more will be needed by March still to keep the systemic liquidity just in equilibrium..... Daily FPI outflows of significant amount and the maturing of forward transactions within 1/2/3 month and hence the RBI will need to infuse further liquidity.'

Liquidity conditions in the banking system have deteriorated significantly over the past few months. In November 2023, the system had a surplus liquidity of Rs 1.35 lakh crore.

However, this quickly turned into a deficit of Rs 65,000 crore in December, which further widened to Rs 2.07 lakh crore in January 2024 and Rs 1.59 lakh crore in February.Several factors have contributed to this situation, including significant foreign portfolio investor (FPI) outflows and the maturing of forward transactions over the next few months.

The report also noted that year-end tax outflows and rising credit demand will likely keep liquidity conditions tight.

To ease liquidity pressures, the RBI has taken several measures, including conducting variable rate repo (VRR) auctions of different tenors, open market operations (OMOs), and dollar-rupee swap arrangements.

The central bank has also carried out daily VRR auctions since January 16 to manage short-term liquidity needs.

So far, the RBI has conducted OMOs worth Rs 1.38 lakh crore, while quarter-end VRR auctions scheduled for April amount to nearly Rs 1.8 lakh crore. Additionally, the central bank has reduced the repo rate by 25 basis points in February 2025 to support liquidity.

The SBI report indicates that despite these efforts, liquidity remains tight. The RBI's daily VRR data shows that the allotted amount as a percentage of bids received has averaged 83 per cent since December 17, 2024.

While the daily liquidity deficit has slightly reduced in March, the overall situation remains concerning due to sustained credit demand and fiscal outflows.

Given these factors, the report estimates that the RBI will need to inject around Rs 1 lakh crore by the end of March to bring liquidity to a balanced level. If liquidity conditions remain tight, the central bank may have to take further measures to stabilize the banking system. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Middle East Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Middle East Star.

More InformationInternational Business

SectionArctic’s Svalbard Seed Vault to receive 14,000 new samples

COPENHAGEN, Denmark: A remote Arctic facility designed to preserve the world's agricultural diversity is set to receive a major new...

RBI may have to infuse Rs 1 Lakh crore by March to maintain liquidity: SBI Report

New Delhi [India], March 4 (ANI): The Reserve Bank of India (RBI) may have to inject additional Rs 1 lakh crore into the banking system...

Trumps tariff plan puts EU economy at risk Bloomberg

The US president has vowed to impose 25% levies on all imports from the bloc US President Donald Trump's plan to impose sweeping...

Microsoft cuts data centre plans and hikes prices in push to make users carry AI costs

After a year of shoehorning generative AI into its flagship products, Microsoft is trying to recoup the costs by raising prices, putting...

RBIs new governor stand of a flexible rupee led to 1.8pc depreciation against USD in 2025: UBI Report

New Delhi [India], March 1 (ANI): The policy shifts by the RBI in managing the Indian currency against the US Dollar have significantly...

Nick Dunlap signs one-match deal with Atlanta Drive

(Photo credit: Kyle Terada-Imagn Images) Nick Dunlap signed a one-match contract with TGL on Friday to fill in for short-handed Atlanta...

International

SectionUS military given 30 days to plan transgender troop removals

WASHINGTON, D.C.: The U.S. military has 30 days to decide how it will find and remove transgender service members. This may involve...

Iowa first to pass law stripping gender identity protections

DES MOINES, Iowa: Iowa lawmakers have passed a new law that removes protections for gender identity from the state's civil rights code....

Rare boost for South Korea as births rise after nearly a decade

SEOUL, South Korea: For the first time in nine years, South Korea recorded a rise in births, offering a rare positive sign in the country's...

US overdose deaths drop 24% to 87,000 in one year

WASHINGTON, D.C.: Nearly 87,000 Americans died from drug overdoses in the 12 months ending September 2024, a 24 percent drop from the...

US dockworkers approve six-year contract, securing major pay hikes

NORTH BERGEN, New Jersey: More than 45,000 U.S. dockworkers have approved a new six-year contract, securing higher wages and preventing...

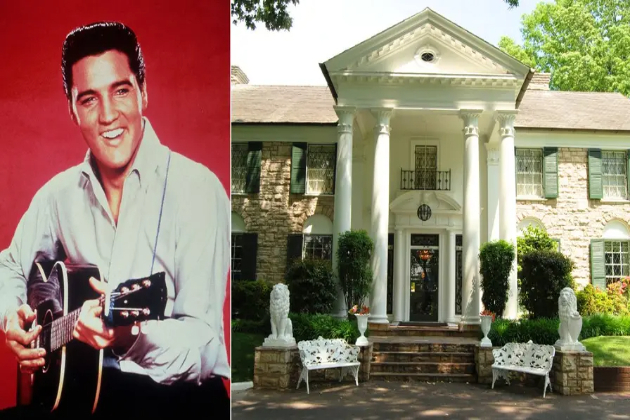

DOJ: Woman charged for trying to defraud Elvis Presley’s family

WASHINGTON, D.C.: A Missouri woman admitted to a scheme to cheat Elvis Presley's family out of millions and take control of Graceland,...