Govt should ease lending restrictions on NBFCs to improve credit for MSMEs: World Bank

ANI

06 Mar 2025, 12:46 GMT+10

New Delhi [India], March 6 (ANI): In a bid to enhance the availability of credit for Micro, Small, and Medium Enterprises (MSMEs), the World Bank, in its latest report, has stated that the government should remove the interest cap on NBFCs to ease the lending restriction.

The World Bank's report outlined several key recommendations aimed at strengthening Non-Banking Financial Companies (NBFCs).

It said, 'Providing adequate financing for micro, small and medium enterprises (MSMEs) by strengthening NBFCs' ability to lend to them by removing the existing interest cap on NBFCs to be eligible for guarantees provided by the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)'

These recommendations focus on improving NBFCs' access to liquidity, easing restrictions on their lending, and introducing risk-sharing mechanisms to facilitate bank funding to NBFCs.

One of the primary measures suggested is the removal of the existing interest cap on NBFCs to be eligible for guarantees under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

By eliminating this cap, the World Bank says that the NBFCs will have greater flexibility in lending to MSMEs, ensuring better access to financing for small businesses.

Additionally, introducing risk-sharing mechanisms for banks that lend to NBFCs would encourage greater participation from the banking sector in supporting NBFC funding.

The tightening of regulatory supervision on NBFCs has led to concerns over liquidity access, particularly for smaller and medium-sized NBFCs.

To address this, the World Bank recommends the introduction of a permanent liquidity arrangement that includes periodic liquidity facilities through development finance institutions (DFIs), Targeted Long-Term Repo Operations (TLTROs), and partial credit guarantee schemes. Such measures would ensure a steady flow of funds for NBFCs, reducing their dependence on short-term borrowing and making financing more accessible for MSMEs.

During the pandemic, government-backed long-term lending support was largely accessible only to well-established and financially sound NBFCs, leaving smaller and medium-sized players struggling for funds.

To prevent a recurrence of such disparities, the World Bank suggests that the government and the Reserve Bank of India (RBI) implement a more structured and permanent liquidity mechanism.

This would provide much-needed stability to NBFCs, particularly those catering to MSMEs, and ensure that smaller lenders are not left behind in times of financial distress.

In conclusion, strengthening NBFCs through regulatory flexibility, improved liquidity access, and risk-sharing mechanisms will significantly enhance their ability to finance MSMEs. The recommendations put forth by the World Bank emphasize the need for a balanced approach--tightening regulatory supervision while simultaneously ensuring NBFCs have adequate liquidity support. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Middle East Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Middle East Star.

More InformationInternational Business

SectionGovt should ease lending restrictions on NBFCs to improve credit for MSMEs: World Bank

New Delhi [India], March 6 (ANI): In a bid to enhance the availability of credit for Micro, Small, and Medium Enterprises (MSMEs),...

"We began Winter Yatra to support people associated with Char-Dham Yatra": U'khand CM Dhami

Harsil (Uttarakhand) [India], March 6 (ANI): Uttarakhand Chief Minister Pushkar Singh Dhami said on Thursday that the State has launched...

PM Modi flags-off trek and bike rally in Uttarakhand's Harsil

Uttarkashi (Uttarakhand) [India], March 6 (ANI): Prime Minister Narendra Modi on Thursday flagged off the trek and bike rally in Harsil...

Uttarakhand: PM Modi joins local artists as they perform folk dance in Mukhwa

Uttarkashi (Uttarakhand) [India], March 6 (ANI): Prime Minister Narendra Modi on Thursday engaged with local artists as they performed...

PM Modi offers prayers at winter seat of Ganga in Mukhwa

Uttarkashi (Uttarakhand) [India], March 6 (ANI): Prime Minister Narendra Modi on Thursday offered prayers at the winter seat of Maa...

Economic Watch: Britain edges towards stagflation amid faltering manufacturing, services

People walk past a sale sign outside a shop during Boxing Day sales in London, Britain, on Dec. 26, 2024. (Xinhua/Li Ying) by Xinhua...

International

SectionUS aircraft carrier in South Korea after North Korea's missile tests

SEOUL, South Korea: A U.S. aircraft carrier reached South Korea over the weekend, shortly after North Korea test-fired cruise missiles...

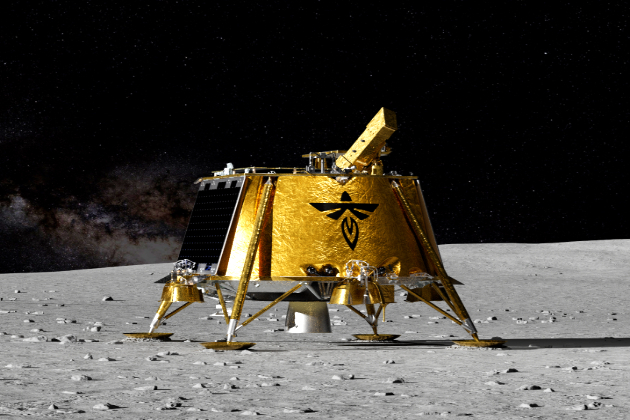

Marking a first, Firefly Aerospace's Blue Ghost lands on the moon

WASHINGTON, D.C.: Firefly Aerospace has achieved a major milestone in private space exploration, successfully landing its Blue Ghost...

NASA launches satellite to map moon's water resources

CAPE CANAVERAL, Florida: This week, a small NASA satellite was launched into space from Florida to find and map water on the moon....

Japan’s birth rate hits record low amid aging population

TOKYO, Japan: The number of babies born in Japan fell to a record low of 720,988 in 2024 for a ninth consecutive year, the health ministry...

Guterres says West Bank settlement expansion and threats of annexation must stop

CAIRO, Egypt - UN Secretary-General Antonio Guterres has warned of the 'alarming situation' unfolding in the West Bank, and says the...

February border arrests near record low, DHS says

WASHINGTON, D.C.: The number of migrants caught crossing the U.S.-Mexico border illegally in February is expected to be one of the...