RBI says banks cannot impose excessive charges on loan amounts upto Rs 50,000 under the priority sector lending

ANI

25 Mar 2025, 09:02 GMT+10

New Delhi [India], March 25 (ANI): The Reserve Bank of India (RBI) has made it clear that banks cannot impose excessive charges, particularly on smaller loan amounts under the priority sector lending (PSL) category.

The central bank stated that no loan-related and ad hoc service charges or inspection charges shall be levied on priority sector loans up to Rs 50,000. This step aims to protect small borrowers from unnecessary financial burdens and ensure fair lending practices.

It said 'No loan related and ad hoc service charges/inspection charges shall be levied on priority sector loans up to Rs 50,000'.

The Reserve Bank of India (RBI) has issued new Master Directions on Priority Sector Lending (PSL), which will come into effect on April 1, 2025. The updated guidelines are set to replace the existing framework established under the 2020 PSL directions.

In these guidelines the central bank has also clarified that loans taken against gold jewellery acquired by banks from Non-Banking Financial Companies (NBFCs) will not be considered under the priority sector lending category. This means banks cannot classify such loans as part of their PSL targets.

The move is intended to ensure that priority sector funds are directed towards sectors that genuinely need financial support, such as small businesses, agriculture, and weaker sections of society.

It said 'Loans against gold jewellery acquired by banks from NBFCs are not eligible for priority sector status'.

The RBI has also assured that all loans categorized under the earlier PSL guidelines (2020 framework) will remain eligible for priority sector classification until their maturity. This move ensures continuity for borrowers and banks, allowing them to follow a smooth transition to the new guidelines.

To ensure better compliance with PSL targets, the RBI will introduce a more rigorous monitoring system. Banks will now be required to submit detailed data on their priority sector advances on a quarterly and annual basis.

As per the guidelines the data must be reported within fifteen days from the end of each quarter and within one month from the end of the financial year. This step is designed to enhance transparency and accountability in PSL implementation.

Banks that fail to meet their prescribed PSL targets will be required to contribute to the Rural Infrastructure Development Fund (RIDF) and other financial schemes administered by NABARD and similar institutions.

This ensures that even if banks do not meet their direct lending obligations, they still support priority sector development through financial contributions.

The RBI has also reaffirmed that outstanding loans extended under specific COVID-19 relief measures will continue to be classified as priority sector lending. This decision is aimed at supporting sectors that are still recovering from the economic impact of the pandemic.

With these new PSL guidelines, the RBI aims to foster financial inclusion and developmental goals. By ensuring that underserved sectors receive the necessary financial support, the central bank is working towards strengthening the nation's socio-economic growth. The updated PSL framework reflects RBI's commitment to ensuring fair lending practices and directing credit to sectors that need it the most. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Middle East Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Middle East Star.

More InformationInternational Business

SectionRBI says banks cannot impose excessive charges on loan amounts upto Rs 50,000 under the priority sector lending

New Delhi [India], March 25 (ANI): The Reserve Bank of India (RBI) has made it clear that banks cannot impose excessive charges, particularly...

Malaysian economy expected to grow between 4.5 pct, 5.5 pct in 2025

This photo taken on Jan. 29, 2024 shows a night view near Petronas Twin Towers in Kuala Lumpur, Malaysia. (Xinhua/Cheng Yiheng) KUALA...

575 publishers from 92 countries to participate in 4th International Booksellers Conference in Sharjah

Sharjah [UAE], March 24 (ANI/WAM): Sheikha Bodour bint Sultan Al Qasimi, Chairperson of the Sharjah Book Authority (SBA), has announced...

IMF rejects Pakistan FBR's request to reduce transaction taxes for property sector

Islamabad [Pakistan], March 24 (ANI): The International Monetary Fund (IMF) has rejected Pakistan's Federal Board of Revenue's (FBR)...

Himachal CM request, HM Amit Shah to release 9,042 crore under PDNA

Shimla (Himachal Pradesh) [India], March 24 (ANI): Himachal Pradesh Chief Minister Sukhvinder Singh Sukhu while interacting with the...

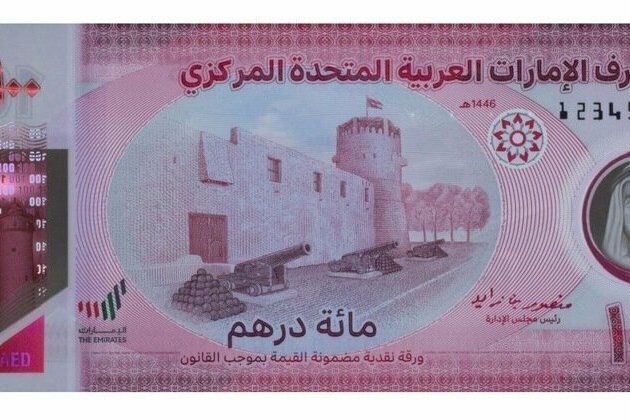

CBUAE issues new AED100 banknote

ABU DHABI, 24th March, 2025 (WAM) -- The Central Bank of the UAE (CBUAE) has launched a new banknote of AED100 denomination, made of...

International

SectionNew York court blocks law allowing over 800,000 non-citizens to vote

NEW YORK CITY, New York: New York State's highest court has struck down a law this week that would have allowed over 800,000 legal...

40 times more people killed in Gaza than in the 7 October attack

The death toll in Gaza on the weekend has passed 50,000, local health authorities have reported. What started the carnage was the Hamas-led...

USDA pledges $100 million for bird flu research, vaccine development

WASHINGTON, D.C.: The U.S. Department of Agriculture (USDA) has announced plans to invest up to US$100 million in research to develop...

US HHS orders removal of gun violence public health advisory

WASHINGTON, D.C.: The U.S. Department of Health and Human Services (HHS) has removed a 2024 advisory from its website that called gun...

Regulatory hurdles may leave US behind China in autonomous tech

WASHINGTON, D.C.: Industry leaders are pushing the Trump administration to clear regulatory obstacles slowing the rollout of self-driving...

Israeli forces accused of deadly cruelty against Gazan hospital patients

NEW YORK, New York – Israeli military forces caused deaths and unnecessary suffering of Palestinian patients while occupying hospitals...